Zambian 2013 Budget Reviewed by Kampamba Shula

On 12 October 2012, the Minister of Finance, Hon. Alexander Bwalya Chikwanda, MP, announced the 2013 National Budget. Budget highlights and taxation and other changes as contained in the Budget speech and the Zambia Revenue Authority (“ZRA”) publication.

INDECO (IDC): Past Problems and Opportunities Analysed by Kampamba Shula

INDECO (IDC): Past Problems and Opportunities Analysed

Critical Review of IMF 2013 Zambia ARTICLE IV CONSULTATION report by Kampamba Shula

Debt management is still on track The agreed norm is that for internal borrowing the threshold is 25 per cent of GDP but our debt stands at K17 billion, which is 15 per cent of GDP and for external borrowing, the threshold is 40 per cent and our debt is US$3.1 billion which is 14 per cent of GDP, so we are far below the agreed norms. So even in the long term , Zambia is still on track.

US Economy 2014 First Quarter Analysis and Outlook by Kampamba Shula

New data shows the U.S. economy contracted in the first quarter of this year, keeping pace with shifting expectations but down sharply from the prior already disappointing estimate.

Zambia Debt Analysis

Some might say that Zambia should not borrow externally and even as sincere as they may be they are wrong. When the Government borrows locally “Crowing out” happens.

Friday, August 31, 2012

The Case for Zero Rated Inputs in Zambian Agriculture

Wednesday, August 22, 2012

Opinion Piece- Wage Wars in Zambia

Tuesday, August 7, 2012

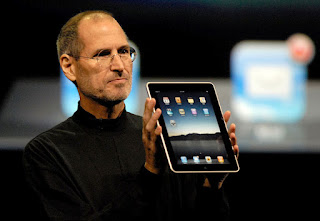

Apple Inc Stock Analysis Complied By Kampamba Shula

Company Description

Apple Inc. and its wholly-owned subsidiaries (collectively "Apple" or the "Company") designs, manufactures and markets mobile communication and media devices, personal computers, and portable digital music players, and sells a variety of related software, services, peripherals, networking solutions, and third-party digital content and applications. The Company's products and services include iPhone®, iPad ®, Mac®, iPod®, Apple TV ®, a portfolio of consumer and professional software applications, the iOS and Mac OS ® X operating systems, iCloud®, and a variety of accessory, service and support offerings. The Company also sells and delivers digital content and applications through the iTunes Store ®, App StoreSM, iBookstoreSM, and Mac App Store. The Company sells its products worldwide through its retail stores, online stores, and direct sales force, as well as through third-party cellular network carriers, wholesalers, retailers, and value-added resellers.

Pundit Analysis

Throughout the extraordinary surge in Apple Inc. (AAPL)’s share price, a persistent question has lingered: Why is the stock still so cheap?

Many theories have been floated for why such a rapidly expanding company with such loyal customers would trade for so little. Perhaps investors believe Apple will cling to its $97.6 billion hoard of cash and marketable securities, rather than pay a fat dividend. Others have suggested a lack of confidence about the future given the death of Steve Jobs. It’s a consumer-electronics company, after all, and competition is brutal(Bloomberg).

There is a very strong sentiment among Apple (AAPL) investors that the stock is undervalued because the P/E ratio is lower than that of other companies in the tech industry, which is understandable. In a negotiated transaction of Apple shares, a very strong case can be made that the P/E multiple should be 23, the average P/E of the S&P 500, which would value Apple at $810 per share. If the price continues to rise at the current pace of 70% in 12 months, it will be $990 by March 2013. Using trailing earnings, the P/E ratio would be about 28, which would still be reasonable given its current growth and strong balance sheet.

The problem with using P/Es for valuation purposes is that there has to be an appropriate benchmark to compare the ratio against. There is currently no company with the same performance and operational metrics as Apple to compare it against. But if we take the P/Es of other technology companies like Dell (DELL): 9, Hewlet Packard (HPQ): 9 and Microsoft (MSFT): 12, then Apple already appears to be priced at a premium (M.Makoni).

Data provided by Capital IQ, except where noted.

| Valuation Measures |

|---|

|

| Financial Highlights |

|---|

| ||||||

| ||||||

| ||||||

| ||||||||||||||||||

| ||||||||||||||

| ||||||

Currently Apple's book value per share is about $110, which gives us a price to book ratio a little over 5. This is higher than Microsoft's (MSFT) 3.5, Research In Motion's (RIMM) 0.35, Nokia's (NOK) 0.75 and Google's (GOOG) 3.1.

Apple enjoys impressively high margins and just as great return on investment rates. Over the last 3 years, Apple's return on investment exceeds 100% and the company's annual gross margins pass 40%. At the end of the day, a company's return on investment and margins tell a story about how well a company is using its current assets and resources to generate income, and Apple is doing a wonderful job at that. The price to book value metric doesn't really take future growth into account. It assumes that the company's assets will be the same for years to come. Investing is future oriented and when we are dealing with strong growth companies like Apple, we need a metric that can actually take its future growth into account, such as forward P/E ratio. For this particular metric, Apple is doing impressively well with a forward P/E ratio well below 10 when the company's cash is added into the equation (why apples book value ratio is irrelevant).

Below is graph of Apples performance in the past 3 years.

Economeka View by Kampamba Shula

Apple is a stock I wouldn't short.Simply put Even though apple's book value may deter investing its PE ratio still looks pretty good.Given its market cap there is no way it can fail to pay its debt of which it has none significant enough to change an investment decision.

Its share price has grown by 300% since 2009.

The reason I feel Investors and the market undervalue Apple is simply because of the nature of its business.Unlike other software companies Apple concentrates on providing high end niche sort of products not like Microsoft and Dell which produce more generic software electronics.

The other main deterrent is the price.Apple trades at about $600 a share.Not many middle income people would spend that much on a stock they are not very sure about.

In conclusion I do agree that Apple has shown immense growth potential and is undoubtedly a Good Investment at least up to 2015 when the market valuation should have stabilized.