Zambian 2013 Budget Reviewed by Kampamba Shula

On 12 October 2012, the Minister of Finance, Hon. Alexander Bwalya Chikwanda, MP, announced the 2013 National Budget. Budget highlights and taxation and other changes as contained in the Budget speech and the Zambia Revenue Authority (“ZRA”) publication.

INDECO (IDC): Past Problems and Opportunities Analysed by Kampamba Shula

INDECO (IDC): Past Problems and Opportunities Analysed

Critical Review of IMF 2013 Zambia ARTICLE IV CONSULTATION report by Kampamba Shula

Debt management is still on track The agreed norm is that for internal borrowing the threshold is 25 per cent of GDP but our debt stands at K17 billion, which is 15 per cent of GDP and for external borrowing, the threshold is 40 per cent and our debt is US$3.1 billion which is 14 per cent of GDP, so we are far below the agreed norms. So even in the long term , Zambia is still on track.

US Economy 2014 First Quarter Analysis and Outlook by Kampamba Shula

New data shows the U.S. economy contracted in the first quarter of this year, keeping pace with shifting expectations but down sharply from the prior already disappointing estimate.

Zambia Debt Analysis

Some might say that Zambia should not borrow externally and even as sincere as they may be they are wrong. When the Government borrows locally “Crowing out” happens.

Friday, June 26, 2020

Tuesday, June 23, 2020

Zambia and the BIG words we use by Kampamba Shula

Why declaring Gold a Strategic Asset is a problem by Kampamba Shula

Friday, November 9, 2018

Currency reserves in metals: The bad guy tales

Can't fathom why people ignore the fact that Nixon decoupled all global currencies off gold in 1971. The only US president to resign for shady stuff.

When I say Zambia lets back the Kwacha in copper people look at me strange like the USA and Roman empire didn't back in metals. 🤦♂️

But let's slow it down.

Let's start with Rome. In the early days of the roman republic (500BC) for the first 178 years, there is no evidence of big inflation. They were using Gold and silver coinage whilst small denominations were made out of copper and bronze.

Then some bad guy by the name Hannibal of carthage started to trouble Rome in what was called the second Punic war and to pay for this war, the Romans did "deficit" spending by taking coins from taxes, melting them and adding base metals like copper so they could mint more coins. This caused big inflation and inflation was one of the factors that brought the roman republic into a dictatorship, the Roman Empire.

Despite this the early Romans enjoyed a long period of basically no inflation because they used sound money, gold and silver. It was the debasing money for war spending that led to problems.

Personally i think the Romans are original bad guys because their moves to debase were slick. Firstly they had a cheating method of whenever they walked into govt offices they would clip their coins and take a piece out.After a while they would melt these clippings and make more money. Secondly the Romans had another trick called revaluation here they would take a coin and just give it new stamp e.g take a K1 coin and stamp K100. These guys were specialists in cheating....I applaud such...👏👏

Now lets rock with the United States from the 1700s Up until the world war one US had low inflation, high levels of precious metals in its coinages and treasury notes were backed by Gold at a one to one ratio. From there the US debased its currency more and more to pay for world war two, the korean war and then the vietnam war until finally the link between gold and the US dollar was severed completely in 1971.

After world war two, IMF was formed at the bretton woods summit to push for global financial stability. IMF gave the world an offer it couldn't refuse, IMF said back your national currency reserves in dollar or in metals. The US had just come out of world war two flexing so it was obvious who had the influence. You can guess what the nations of the world chose, they backed in dollars. So IMF said everyone will back in dollars and the US will back in gold and everyone was cool.

Now here comes a real shady bad guy, US president Nixon who was known for criminal activities like wiretapping and spying on the competition (watergate scandal) but his greatest crime came on August 15th 1971 when he severed the last ties between the dollar and gold ending the bretton woods system. These were his words:

"I have directed secretary connolly to suspend all convertibility of the dollar into gold all other convertible assets, except in amounts and conditions determined to be in the best interest of the United States"

Nixon pulled the most shady move ever and the world just watched and agreed as we all moved to a fiat system. This was a bad guy move, to be impartial it must be applauded 👏👏. Nixon later resigned, not for the gold issue but because he was facing certain impeachment for his shady moves in the watergate scandal.

In summary all I am saying is African countries like Zambia, Zimbabwe and DRC Congo need to back our currencies in metals. Yes its cheating on a moral scale but its perfectly within IMF articles.

Some will say but Zambia is christian nation we dont cheat. The same coin that Jesus was given when asked on tax was made of copper at 1/4 probability. Jesus said "Give to ceasar what belongs to ceasar"...he didnt say nothing about how you got what you gave to ceasar.

"History Doesn't Repeat Itself, But it Sure Does Rhyme " - Mark Twain

Friday, October 5, 2018

The Tokota Theorem – A Sociological and Economic Approach to Youth Crime

https://www.researchgate.net/profile/Kampamba_Shula3/publication/327537100_The_Tokota_Theorem_-_A_Sociological_and_Economic_Approach_to_Youth_Crime/links/5b979666458515310578363b/The-Tokota-Theorem-A-Sociological-and-Economic-Approach-to-Youth-Crime.pdf?origin=publication_detail

The John Mwanza Formula – Comparative static analysis of tax revenue, compliance and evasion in Zambia by Kampamba Shula

The Private Sector in Zambia and the Government have for a long time been at loggerheads with regards to tax rates and revenue. Government wants more revenue which usually tends to support suggestions for increasing tax rates. This tendency can best be explained by the “Law of the instrument” a phrase from Abraham Maslow’s The Psychology of Science, published in 1966 which says “if all you have is a hammer, everything looks like a nail”. The Private sector on the other hand have been searching and looking for ways to convince Government to reduce tax rates and stimulate growth which will lead to higher revenue. The Private sector has recently stressed the effects of tax evasion on Tax revenue loss. This apparent catch 22 motivated a more critical look at the factors affecting tax revenue in Zambia.

Rebasing GDP: The Bossano Example

Imagine a household far away in a land called Chambia (I know, I couldn’t resist) lives a man called Bossano, who has a very big house and in this house he has family, extended family and some foreign tenants who stay with him. Most of tenants and extended family do some work of some sort and earn a living except the young ones not yet of age. But when they do become of age and begin working, he taxes them a ration for part of the money spent on taking them to school, hope you get the drift. Now everyone in this house has to pay Bossano a ration, which he uses to take some children to school, keeps the lights on (Zesco),water, food, plus he has to pay some workers who grow crops for him and his household (FISP/FRA) and other expenses .etc.

Now Bossano has a lot of pressure so he borrows heavily from two guys Euro Banda (Euro Bond) and Choncholi getting into major debt. He uses this debt for many things like building a house for rent and other investments that take time to give a return. Bossano's total ration collection can be considered Government tax collection and the total money his household makes including extended family and tenants can be considered as GDP (gross product...everything put together).

Here is the catch, Bossano needs some loan support and some guy by the name “IMFwiti” is a major don in this imaginary land and he gives loans to people on certain conditions. Everyone respects IMFwiti, and the standard way that he measures someone’s ability to sustainably pay debt. The International standard (Threshold) for measuring debt according to IMFwiti is to calculate the debt and divide it by the total amount his HOUSEHOLD makes, NOT his rations, please note the difference. Now IMFwiti and Choncholi don’t really vibe together and he and Bossano have an argument (That is story we won’t get into here) but they still trying to work things out after all IMFwiti is still a Global don.

Now let’s get back to Bossano and explain this rebasing. Over time the money that Bossano’s household makes is adjusted for prices or in Bossano's case this means to include extended family members who never made any money some time back but are making some now. This recalculation is given a fancy term in economics and is called rebasing. Basically it means Bossano after sometime usually calculates how much his extended family make because he doesn't really count how much they make properly often. You might rightly ask why Bossano doesn’t calculate how much his household makes properly. The answer to this is because some of his extended family are in formal employment with salaries (formal sector) which is easy to count whilst others (Most of them in fact) are tamanga guys (informal sector) who hustle on the street, they make money too it just doesn’t appear on a pay slip if you know what I mean, which makes it difficult to estimate how much they make. Plus over time the things his household produces (especially the informal guys) change so he has to take this into consideration.

So when the Zambian Government rebases GDP in 2019 it will be the same as Bossano recalculating how much the earnings of this total household have changed with time (Properly estimating how much informal guys are making), taking into account the prices of the things his household makes. The base in “rebase” refers to a year when changes in household earnings are being calculated. So basically rebasing is changing or updating the year from which Bossano calculates total household earnings.

You probably wondering if developed countries rebase their GDP, the answer is basically, no. It is what you would call mainly an Africa Problem. Ghana did it, Nigeria did it and now Zambia is doing it for the second time having done it in 2014. The economic size of the country is not fully reflected in nominal GDP. Two arguments to support that GDP is understated. One is that informality in the economy is high and part of the economy is not documented, hence that pie is missing from officially reported GDP. The other argument is that there are new services coming into the urban centers and old computation techniques based on existing GDP base are not fully reflecting the modernization of economy; hence urban contribution to GDP is undervalued.

Now if you remember, I explained that everyone respects IMFwiti (who is obviously IMF), and the standard way that IMF measures a country’s ability to sustainably pay debt. The International standard (Threshold) for measuring debt according to IMF is to calculate the debt and divide it by the GDP (Gross Domestic Product), NOT tax collections (rations), please note the difference. Hence when a country rebases its GDP it technically reduces the debt to GDP ratio (in a math fraction if you increase the denominator, the total number reduces .e.g. 3/7 is greater than 3/20). Rebasing GDP is the same as inflating GDP for accuracy. Its normal in African Countries, the only strange thing is Zambia will be rebasing after just five years i.e. last rebase was 2014. This means Bossano is either not measuring the informal sector well or he may have an incentive to inflate the GDP numbers to understate debt, current account and fiscal deficits.

Either way I think it’s the smart move, but you can make your own conclusions. I’m just a guy with round glasses, you don’t have to take my word for it.

Monday, March 23, 2015

The Inevitable Depreciation of the Zambian Kwacha - Causes, Consequences and Policy

In Zambia outside the minerals sector, exported output is low, imported inputs high, and foreign currency debt low. These combine to create a strong probability that a depreciation of the currency would generate net disincentives to agricultural and manufacturing producers in Zambia. It is for this reason that many in the government and the private sector argue in favor of a "strong" (appreciating) currency, as a necessary support for diversification into agriculture and manufacturing.

Currency appreciation is a blunt instrument to stimulate diversification, all the more because other instruments not involving the exchange rate can better target the desired outcome of domestic output and export diversification. This is the policy dilemma that exists in Zambia. The current policy attempts to promote diversification, but at the same time prevents the incentive for exporters to gain from increased foreign revenue. This is the same as attempting to cut a loaf of bread with a spoon; it’s very possible but clearly not a preferable course of action in light of conventional etiquette.

If an economy is at less than full utilization of resources an appreciation will tend to reduce aggregate demand. The demand reducing effect comes through the cheapening of imports which would in the medium term lower domestic production of importables. For a non-diversified developing country, Zambia being an obvious case, nominal appreciation should result from long run increases in the productivity of exportables combined with declining structural inflation. This combination allows for continued export competitiveness and a "stronger" currency. Obvious examples of countries experiencing this benign combination are Japan and Korea. For Zambia this combination lies in the distant future. How distant that future is depends on policy implementation.

Copper dominates the external trade of Zambia, and the nominal exchange rate has little short term impact on metal production or export. Zambia does not export copper because of comparative advantage in which relative factor scarcities determine comparative costs. In the case of Zambia, copper exports result from a specific natural endowment. In the absence of policy intervention by the Zambian government or Bank of Zambia, the level of the Kwacha responds to domestic copper production and the international price, on the one hand, and the international prices and domestic demand for major imports.

In 2014 the Kwacha depreciated by 14% against the US dollar, whilst over the first quarter of this year it has depreciated by 15.6%.

Exchange rate movements are strongly affected by the policies of the mining companies as to where they deposit and hold their export earnings. Were the mining sector in public ownership or if the private companies operated with full transparency, reported domestic production exports would accurately indicate foreign exchange earnings from the sector.

The supply of foreign exchange by the mining sector has recently fallen relative to demand, and this cannot be purely explained by the reduction in domestic production because we have seen higher mining sector exports in 2014. The world copper price is the major short term influence on the level of domestic production, and this is the most important determinant of exports. This production requires imported inputs, and the copper sector trade balance represents by far the largest component of the overall trade balance. The foreign exchange market policies of the mining companies directly impact on flow of export revenue into the national economy.

Diverging central bank policy has created a perfect launch pad for the dollar to move higher, particularly against the euro. The recent strengthening of the US dollar globally is also a reflection of the demand for US dollars relative to other currencies including the Kwacha.

Inspection of the capital account balance shows a substantial increase in its instability since 2009. Because of the overwhelming importance of copper in the Zambian economy, it is obviously the case that the metals sector would be a primary determinant of capital account movements

The exchange rate of the Kwacha against other currencies is determined in the interbank market. This market responds to both fundamental factors such as some of the demand and supply factors related to external trade, but it also responds to sentiments which tend to drive demand and supply away from fundamentals. Other issues have been raised with respect to mining tax policy and value added tax which also impact on sentiment in the market.

The deterioration in the external sector continued in the fourth quarter of 2014 and the situation seems to be worsening at the beginning of 2015. Overall balance of payments deficit widened driven by unfavorable performance in both the current and financial accounts. The decline in export earnings is mainly explained by a contraction of 7.8% in copper export earnings following a decline in export volumes and averaged realized copper prices. The current account in 2014 registered a deficit of US $431 million, when compared to a deficit of US $284 million in 2013. Non-traditional exports fell from of US $3.6 billion in 2013 to an estimated US $2.2 billion in 2014 a drop of 39%.

The hard reality of Zambia’s so-called liberalized reforms when placed against other liberalized markets of the US, Japan and the European Union (EU) shows that Zambia’s money markets are not liberalized due to structural imbalances in allowing for equal access to US dollar inflows.

For many years the Zambian Government, NGOs, General Public and other stakeholders have talked about how much Zambia needed to diversify its economy away from copper. Despite a good

performance in non-traditional exports over the past decade, copper still accounts for over 70% of Zambia’s exports. That statistic alone shows that the diversification policy has failed to live up to its expectations.

Unless the export base expands the depreciation of the Zambian Kwacha, however moderate is inevitable. As long as policy makers continue to use the exchange rate as a policy instrument to stimulate diversification instead of using better tools, this policy will be an exercise in futility, however moderate.

Monetary Policy; The Bank of Zambia needs to look at alternative measures of Quantitative tightening. Raising interest rates and reserve ratios are overused policy instruments which usually squeeze credit liquidity and make borrowing expensive for most stakeholders. There is another option, its effectiveness is up for debate but it is always worth the try. It is reverse quantitative easing or otherwise known as quantitative tightening. But this one is specific to the bond market. This means the Bank of Zambia will trade long term treasuries for short term treasuries, effectively draining the market of liquidity, without raising the rates. For this to work it would require shortening treasury periods from 3 months to one month to make it more effective. This is by no means guaranteed to be effective but it is a tool at the disposal of the Bank of Zambia.

Secondly, the Bank of Zambia needs to make a concerted effort to make the foreign exchange market in Zambia more asymmetrical in terms of information and access to foreign exchange flows. The market in its current state has structural imbalances caused by a skewed control by mining companies and a few big traders. Sorting this out will prevent consistent deviations of the Zambian Kwacha from fundamental levels.

Thirdly, the Ministry of Finance needs to aid the Bank of Zambia by Identifying the relevant practices by the mining companies, how these impact on the balance of payments, and whether government policy intervention is necessary. This area needs to be looked into thoroughly.

Another policy recommendation regards how Official foreign exchange flows report that Switzerland is the largest importer of Zambian copper, a confusing statistic. Inspection of statistics from Switzerland show that the country neither imports nor exports copper, merely serving as the site for the buying and selling of copper contracts without any physical trade in copper ore or copper in any stage of processing. The ministry of Finance in collaboration with the Bank of Zambia and Ministry of Mines should create a copper contract exchange which mirrors and facilitates the same trade taking place in Switzerland. This option will require resolve as Zambia may effectively be cutting out a middleman.

The last recommendation refers to the use of currency appreciation as a policy tool for diversification. This has to stop. If the Kwacha depreciates fundamentally, then let it depreciate moderately. Import input costs are high because of other reasons than merely the exchange rate. Zambia can review its import tariffs on inputs and even introduce tax relief for importers of inputs for manufacturing which has a higher return on tradables as the sectoral price indices indicate that the relative return was higher from manufacturing than agriculture. In short, policy should focus more on diversifying into manufacturing while looking for ways to increase productivity in agriculture.

Friday, March 13, 2015

Strong Dollar - An Inflated Currency in a Deflated Global Economy by Kampamba Shula

With flexible exchange rates and wide-spread abandonment of capital controls the dollar is largely free to move up or down as market forces dictate

In this framework it is reasonable to infer that any observed weakening or depreciation of the dollar is most likely the result of a reduced demand for dollars in the foreign exchange market, an increased supply of dollars in that market, or some combination of both forces. Similarly, an appreciating, or strong dollar, is the consequence of an increase in the demand for dollars, or a decreased supply of dollars, or both in the foreign exchange markets.

The volume and speed of international asset transactions far exceed those of goods transactions. This means that at any point in time it is most likely that the relative demand for assets here and abroad will be the dominant force in the foreign exchange market, transmitting the essential energy that drives movement in the exchange rate for the dollar and other widely traded currencies.

Expectations about the future path of the exchange rate itself will figure prominently in the investor’s calculation of what she will actually earn from an investment denominated in another currency. Even a high nominal return would not be attractive if one expects the denominating currency to depreciate at a similar or greater rate and erase all economic gain. On the other hand, if the exchange rate is expected to appreciate the realized gain would be greater than what the nominal interest rate alone would indicate and the asset looks more attractive.

There is also likely to be a significant safe-haven effect behind some capital flows. This is really just another manifestation of the balancing of risk and reward by foreign investors. Some investors may be willing to give up a significant amount of return if an economy offers them a particularly low risk repository for their funds. In recent decades the United States, with a long history of stable government, steady economic growth, and large and efficient financial markets can be expected to draw foreign capital for this reason.

The greenback is trading at a 12-year high against the euro and 8-year high versus the Japanese yen. This strength is, in many respects, a sign that the economy in the United States is much healthier than Europe, Japan and many other parts of the world. The strengthening of the USD in recent times has caused some element of volatility in the currency markets across the globe and almost all emerging markets' currencies have been affected on this score as they have tended to depreciate.

The US Federal Reserve has withdrawn the QE completely on the premise that the economy is picking up and that unemployment levels are low and within acceptable limits. This indicates that the economy is going to record a healthy growth rate from 2015 onwards. Also, interest rates are expected to increase in mid-2015 with the Fed tracking the inflation numbers.

Quantitative easing meanwhile continues to be dominating the economies of Japan and the euro region with China is also showing signs of easing rates. Any kind of affirmative action to revive an economy is taken to mean a weak economy and by implication a weak currency. This has propped up the USD which appears to be the strongest currency today.

Diverging central bank policy has created a perfect launch pad for the dollar to move higher, particularly against the euro. The Fed is expected to push interest rates higher in the next several months, while the European Central Bank embarked on a quantitative easing bond buying program recently. Some analysts expect the Fed to hike rates in September. The currency-weakening moves by the SNB, ECB and others across the globe have spurred talk about a renewed currency war as countries adopt a beggar-thyneighbor policy to spur growth.

Generally, the financial health of a country, as measured by deficits and debt and forecasts of deficits and debt accumulation, plays an important role in driving the relative currency valuation of a particular country. Countries that have chronic deficits and growing debt burdens ultimately end up in a weaker position in the foreign exchange markets, albeit sometimes with considerable lag times.

The present strength of the dollar is temporary and can also be seen as the penultimate stop in a flight to safety. When the next financial crisis unfolds as it surely will gold, precious metals and even structured alternatives like bitcoin are likely to be the next and last stop.

Predicting the path of the dollar is always a problematic endeavor. Economic fundamentals predict that the dollars near-term path will broadly reflect the resolution by international investors of an ongoing balancing of risk and return.

Economic growth in the United States in 2014 showed signs of recovery and this may have translated into an increase of the expected return on dollar assets. In addition, the Fed is expected in mid-2015 to increase short-term interest rates. In contrast, both the euro area and Japan have demonstrated that they have firmly established economic contractions underway, and they have currencies that are not expected to appreciate. These changes suggest that the expected yield advantage of dollar assets has been strengthened. If so, this presents foreign investors, with an already strong need to diversify into dollar assets of an attractive sustained and safe rate of return. This change in incentives could be sufficient to induce a significant move away from yen and euro assets.

The US dollar is expected to appreciate over the near term against major convertibles. The reason for this is mostly down to a global monetary policy divergence between the U.S and the rest of the world. With the EU and Japan fighting deflation using QE, they are inadvertently propping up the Dollar.

This appreciation of the Dollar though due in a small part to stronger US growth is at the most part an inflated effect of deflated global economy. A disorderly adjustment is probable, but not inevitable.

Click here to download the full report

Tuesday, March 10, 2015

Oil Price Fall: Supply, Demand and Outlook

Following four years of relative stability at around $105 per barrel (bbl), oil prices have declined sharply since June 2014 and are expected to remain low for a considerable period of time. The drop in prices likely marks the end of the commodity supercycle that began in the early 2000s.

The sharp fall in oil prices since June 2014 is a significant but not unprecedented event. Over the past three decades, five other episodes of oil price declines of 30 percent or more in a seven-month period occurred, coinciding with major changes in the global economy and oil markets (Figure 1). The latest episode has some significant parallels with the price collapse in 1985-86, which followed a period of strong expansion of supply from non-OPEC countries and the eventual decision by OPEC to forgo price targeting and increase production.

According to the World Bank, the recent plunge in oil prices has been driven by a number of factors: several years of upward surprises in the production of unconventional oil; weakening global demand; a significant shift in OPEC policy; unwinding of some geopolitical risks; and an appreciation of the U.S. dollar. Although the relative importance of each factor is difficult to pin down, OPEC’s renouncement of price support and rapid expansion of oil supply from unconventional sources appear to have played a crucial role since mid-2014. Empirical estimates also indicate that supply (much more than demand) factors have accounted for the lion’s share of the latest plunge in oil prices. Although the supply capacity of relatively high-cost and flexible producers, such as the shale oil industry in the United States, will need to adjust to lower prices, most of the underlying factors point to lower oil prices persisting over the medium-term, with considerable volatility in global oil markets (World Bank, 2015).

The decline in oil prices will lead to significant real income shifts from oil exporters to oil importers, likely resulting in a net positive effect for global activity over the medium term. A supply-driven decline of 45 percent in oil prices could be associated with a 0.7-0.8 percent increase in global GDP over the medium term and a temporary decline in global inflation of around 1 percentage point in the short term.

Over the medium term, oil prices are projected to recover from their current lows, but will remain below recent peaks and witness considerable volatility for a couple of years. The pace of the recovery in prices will largely depend on the speed at which supply will adjust to weaker demand conditions. Given that OPEC, for now, appears to have relinquished to its role as swing producer, US shale oil producers, with their relatively short production cycles and low sunk costs, may see the greatest adjustments in the short term. In the longer term, adjustment will take place from both conventional and unconventional sources through cancellation of projects. While supply is likely to be curtailed, demand is expected to pick up, along with the expected recovery in global activity and in line with broader demographic trends. However, predictions on the evolution of oil markets remain highly uncertain. Commodity prices, including oil, tend to be volatile, making forecasting prone to errors. For oil, the unpredictability is further amplified by the possibility of heightened geopolitical tensions and a sudden change in expectations regarding OPEC’s policy objectives. Over the long run, physical (geological) constraints should put upward pressure on the real price of oil, although technological advances could slow the increase.

Click here to Download the Full Report: Oil Price Fall_Supply_Demand_and_Outlook

Tuesday, October 21, 2014

Zambia Budget Review: Revenue and Expenditure (2004-2014) by Kampamba Shula

1.

Trend analysis

1.1.

Revenue

1.1.1.

Overview

1.2.

1.3.

Expenditure

1.3.1.

Overview

Monday, October 13, 2014

2015 Budget Review and Analysis by Kampamba Shula

2015 Budget

1.1. Economic developments in 2014

• Current estimates are that the Zambia economy will create 120,000 new formal sector jobs mostly from the private sector.

• Preliminary projections are that real GDP growth will be higher than the projected 6.5 percent for this year. This will be mainly driven by a good harvest in the 2013/2014 farming season, increased electricity generation, investments in private and public infrastructure and growth in manufacturing as well as in transport and communications.

• The Treasury took measures to consolidate the fiscal position. These measures included actions to contain the size of the public sector wage bill and streamlining of expenditure towards priority programmes. As a consequence, the end year budget deficit is expected to be within the programmed level of 5.5 percent of GDP compared to 6.5 percent in 2013.

• Inflation was contained within single digits over the first nine months and was 7.8 percent in September 2014 from 7.1 percent in December 2013. The slight increase was due to the depreciation of the Kwacha, mainly in the first half of the year, and the pass-through from upward adjustments in fuel prices and electricity tariffs.

• The first half of 2014 experienced a rapid depreciation of the Kwacha against major currencies, reaching a high of K7 per US dollar in May. This partly arose from a reduction in the supply of foreign exchange to the market, particularly from the mining sector, and subsequent speculative behaviour. In response, the Bank of Zambia tightened monetary policy through a number of measures, including adjusting upwards the policy rate, increasing the statutory reserve requirement and extending its application to Government and Vostro accounts.

• The tight liquidity conditions came at the cost of a temporary rise in interest rates which constrained access to credit. Having achieved relative stability in the foreign exchange market, the Bank of Zambia has, since July 2014, eased liquidity conditions. As a result, the daily average overnight interbank rate reduced to 12.8 percent as at end-September 2014 from 25 percent at end-June 2014.

• During 2014, trading activity on the Lusaka Stock Exchange (LuSE) increased, reflecting improved investor sentiment and participation on the local bourse. Market capitalisation increased by 8 percent to K62.9 billion while the All-Share index rose by 17 percent to 6,620.9 by end-September 2014.

• To comply with the LuSE listing requirements, Government will itself reduce its shareholding in ZCCM Investments Holding Plc to 60 percent from 87 percent.

• The overall Balance of Payments is expected to register a surplus of US $486.0 million in 2014 compared to a deficit of US $344.9 million in 2013. This surplus is attributed to improvements in both the current and financial accounts. Higher copper export volumes and the receipt of Eurobond proceeds account for the expected improvements.

• Consistent with improvement in the overall Balance of Payments position, gross international reserves are projected to increase to US $3.2 billion at end-December 2014, representing 3.6 months of import cover, from US $2.7 billion or 3.0 months of import cover recorded at end-December 2013.

• The stock of Government’s external debt as at end-September 2014 was US $4.7 billion. This represents an increase of 34 percent from US $3.5 billion as at end 2013. The increase in the external debt stock was mainly on account of the US $1 billion Eurobond that was issued in April as part of programmed financing in the 2014 budget. The total external debt service for the first nine months of 2014 amounted to US $126.2 million which is less than 3 percent of the domestic revenues.

• Zambia’s domestic debt including arrears as at end-September 2014 stood at K21.9 billion representing an increase of 5.6 percent from K19.7 billion as at end-December 2013. The increase was largely on account of programmed financing for the 2014 Budget.

1.2. Macroeconomic Objectives, Policies and Strategies for 2015

The Government in 2015 will continue to focus on industrialisation together with job and wealth creation, so as to reduce poverty and inequality on a sustainable basis. This will be achieved by investing in sectors that have been identified to best promote employment for our youthful population, significantly increase productivity in the economy by empowering our workers with the requisite skills for the 21st century, contribute to higher and inclusive economic growth, and develop the rural areas to narrow the urban-rural divide. These include the agriculture, tourism, manufacturing and construction sectors.

The specific broad socio-economic policy objectives for 2015 will be to:

(a) Achieve a real GDP growth rate of above 7.0 percent;

(b) Achieve an end year inflation rate of no more than 7.0 percent;

(c) Increase international reserves to at least 4.0 months of import cover;

(d) Raise domestic revenue collections to at least 18.5 percent of GDP;

(e) Contain domestic borrowing to no more than 2.0 percent of GDP;

(f) Accelerate the diversification of the economy, and continue the drive to create decent jobs, especially for the youth; and

(g) Accelerate implementation of interventions in the health, education and water and sanitation sectors.

1.3. 2015 Budget

In 2015, Government proposes to spend K46.7 billion or 24.6 percent of GDP. This will be financed from domestic revenues of K35.1 billion which is 75.2 percent of the total Budget and 18.5 percent of GDP. Grants from cooperating partners of K1.2 billion or 2.6 percent of the total budget will complement domestic revenues. Domestic borrowing is projected to be 2.0 percent of GDP translating to K3.8 billion while K4.2 billion is a combination of foreign programme and project financing. The balance of K2.4 billion is earmarked proceeds from the 2014 Eurobond.

1.3.1. 2015 Expenditure Allocations by Function

1.3.1.1. General Public Services

• K12.0 billion or 25.8 percent of the budget has been allocated for General Public Services. To ensure that Government meets both its domestic and external debt obligations, K2.9 billion and K2.4 billion have been provided respectively. Other notable expenditure allocations under this category include K669.4 million for grants to Local Authorities of which K586.8 million is for the Local Government Equalisation Fund.

• To ensure the continuation of infrastructure development in the newly created provinces and districts, K500 million has been provided in 2015. Further K210 million has been allocated for the Constituency Development Fund.

• The constitution making process has continued keenly and in earnest, as the Government discusses the matter with all interest groups it has allocated K29.3 million towards this process.

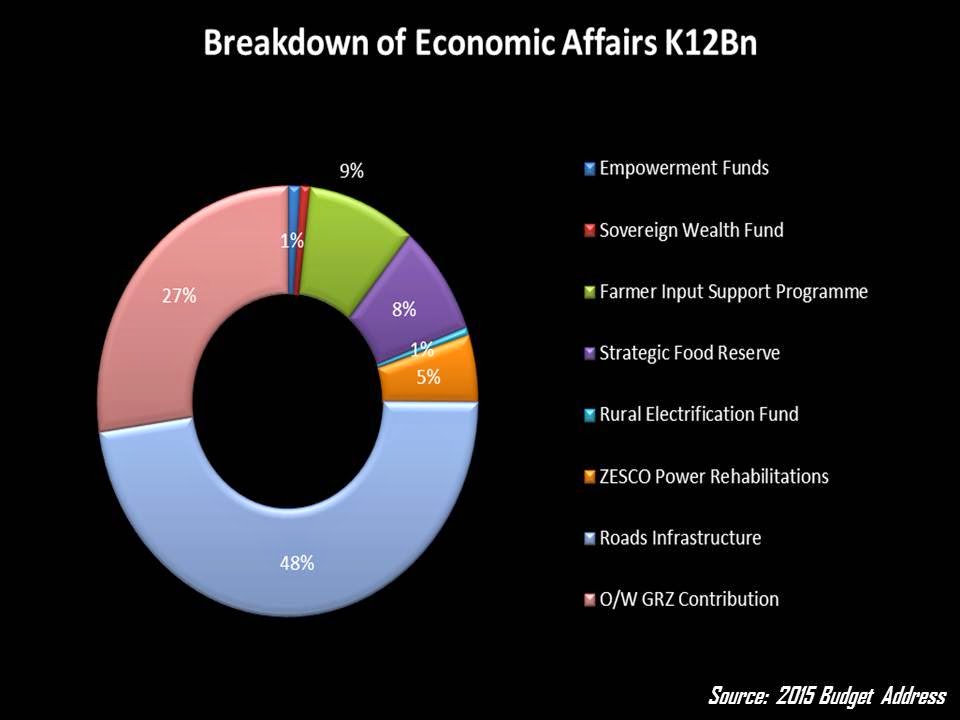

1.3.1.2. Economic Affairs

• Government proposes to spend K12.7 billion or 27.3 percent of the total budget to support the economic sectors and lays the basis for further prosperity for our people. In this regard, an allocation of K5.6 billion has been set aside for road infrastructure, including the Link Zambia 8000 and the Pave Zambia 2000 projects.

• Diversification from maize remains paramount in attaining more inclusive growth and economic independence. In this regard, K254.9 million has been allocated towards the E-Voucher System which will allow farmers more flexibility of choice in the inputs they receive. A further, K1.1 billion has been allocated to the Farmer Input Support Programme (FISP). In 2015, it is expected that 1,000,000 farmers will access inputs through the E-Voucher and FISP programmes.

• Government will continue promoting private sector participation in grain marketing by limiting grain purchases by the Food Reserve Agency to the 500,000 metric tonnes required for the strategic food reserve. In this regard, Government has provided K992.9 million for strategic food reserves.

• To promote irrigated agriculture and increased access to water resources, Government has allocated K164.5 million towards the construction and rehabilitation of dams to achieve our target of an additional 17,500 hectares under irrigation by 2016.

• To promote livestock and fisheries, Government has allocated K307 million for livestock disease control measures and aquaculture development.

• To address the challenges posed by the ever growing demand for electricity, Government has provided K600 million to ZESCO for power generation, transmission and distribution. A further K70.7 million has been allocated to increase the number of rural communities across the country connected to the national grid under the Rural Electrification Programme.

• To continue nurturing the entrepreneurial spirit Government has allocated K123.7 million to various empowerment funds that cater for the youth, women and SMEs

• Government has allocated K100 million for the establishment of a sovereign wealth fund. Going forward, a significant propotion of the dividends from state-owned enterprises that will fall under the Industrial Development Corporation will form part of the fund.

1.3.1.3. Education and Skills Development

Government proposes to spend K9.4 billion or 20.2 percent of the total budget in the education sector. In an effort to reduce the pupil teacher ratio, 68 percent of this amount will go towards the recruitment of 5,000 teachers and sustaining the current establishment. Government has also provided K1.1 billion for infrastructure development for early childhood, primary and secondary education.

K650 million has been allocated to commence construction of additional student accommodation at the University of Zambia, Copperbelt University, Mulungushi University and Evelyn Hone College, and to continue the construction of new universities. The new Universities that are earmarked for completion in 2015 are Paul Mushindo, Chalimbana and Palabana.

Government will embark on the construction of King Lewanika and Luapula Universities in 2015.Robert Kapasa Makasa, Mukuba and Kwame Nkrumah Universities are almost completed.

A further K79.6 million has been allocated towards the construction of nine trades training institutes across the country of which three will be completed in 2015 in Isoka, Kalabo and Mwense. In addition, K28.5 million has been allocated towards the procurement of research and development equipment as well as the commencement of the construction of a National Science Centre in Chongwe, a Fisheries Centre in Samfya and a Mineral Research Centre in Solwezi.

To address the challenges facing our vulnerable school leavers to access tertiary education at our colleges and universities, Government has raised the allocation to bursaries by 27.9 percent to K200.2 million from the 2014 allocation of K156.5 million. The cost of publicly provided tertiary education per student is among the highest in the SADC region.

1.3.1.4. Health

In line with Government’s objective of providing equitable access to quality health care, Government has allocated K4.5 billion or 9.6 percent of the overall budget in 2015 to the Health Sector. Of this allocation, K268.2 million has been allocated for the construction and rehabilitation of health infrastructure in various parts of the country.

An allocation of K753.5 million has been set aside for the procurement of essential drugs and medical supplies. K52.5 million has been allocated for the net recruitment of over 2,000 health personnel.

1.3.1.5. Housing and Community Amenities

Government has allocated K798.7 million for housing and community amenities, of which K541 million will be for the rehabilitation and construction of water supply and sanitation infrastructure in the rural, peri-urban and urban areas.

1.3.1.6. Public Order and Safety

K2.2 billion has been allocated to maintain public order and safety. Key interventions will involve modernisation of our security wings; recruitment of security personnel including immigration and prison officers; rehabilitation of prison infrastructure; and construction and rehabilitation of staff houses.

1.3.1.7. Social Protection

Government has provided K1.3 billion for social protection of which K805 million is for the Public Service Pension Fund, K180.6 million for the social cash transfer scheme and K50 million for the food security pack. The allocation to social protection translates to 2.7 percent of the overall expenditure in 2015.

1.3.1.8. Other functions

K3.7 billion has been allocated to the remaining functions of Defence, Environmental Protection and Recreation, Culture and Religion. Of this amount, K3.2 billion is for Defence.

1.3.2. Revenue Estimates and Financing

The proposed revenue measures have been framed in the context of Government’s aim to consolidate its fiscal position and make the tax system simpler and more effective. This entails, inter alia, accelerating the modernisation of tax administration and restructuring the current mining tax regime in order to capture more resources to address public expenditure needs.

1.3.2.1. Revenue Measures

• Government proposes to double the presumptive tax payable by these operators. This measure will raise additional revenue of K3.8 million.

• Government proposes to increase the specific duty rate on refined edible oil to K2.20 per kilogram from 85 Ngwee per kilogram in order to bring it at par with the ad valorem rate of 25 percent charged on imported refined edible oil

• In order to stimulate the local manufacturing industry and sustain employment in the sector, Government proposes to increase customs duty on explosives to 25 percent and on roofing sheets to 30 percent.

• Government proposes to increase excise duty on imported un-denatured spirits of alcoholic content of 80 percent or higher by volume to 125 percent from 0 percent. This proposed measure will only apply to importers who are not licensed to manufacture excisable products while the licensed manufacturers will continue to account for excise duty at the point of sale of the manufactured potable spirits at the current excise duty rate of 60 percent.

• Government proposes to remove the 5 percent customs duty on aviation fuel in order to reduce costs in the aviation industry. As a result of this measure Government will forego K6.3 million in revenue.

1.4. Changes to the Mining Fiscal Regime

Government and the mining companies, Government proposes to redesign the mining fiscal regime by replacing the current two tier system with the following simplified mining tax structure:

a) 8 percent mineral royalty for underground mining operations as a final tax;

b) 20 percent mineral royalty for open cast mining operations as a final tax;

c) 30 percent corporate income tax rate on income earned from tolling; and

d) 30 percent corporate income tax rate on income earned from processing of purchased mineral ores, concentrates and any other semi-processed minerals, currently taxed as income from mining operations.

The proposed changes to the mining tax regime will not apply to mining of industrial minerals. The expected additional revenues, in 2015, as a result of these new measures are estimated at K1.7 billion.

Analysis

The 2015 Budget is in line with the Medium term expenditure framework (2015-2017). The contentious issue arising from this budget is most prominently the Wage Freeze. In September 2013 the Zambian Government approved a harmonious increase of wages for civil servants. The increase was as much as 100% for some civil servants. The wage increase was much anticipated but its size was larger than predicted. To balance this out the Government introduced a wage freeze on the salaries of civil servants for 2 years.There have been calls from people in the media and others to drop the wage freeze.In truth and in free market legality the Government was not supposed to impose a wage freeze. But a closer look at the fiscal position indicates that Government cannot actually afford to drop the wage freeze right now after the unilateral increase in 2013. Unions will continue to fight the wage and they should (its their job) but the wage freeze might only be dropped in 2016.

The mining fiscal regime change is a bold move towards royalty taxes and its success will hinge on the Zambian Governments ability to actually monitor and evaluate the effectiveness of the new tax system.

Debt levels of $4.7 billion and K21.9 billion for external and domestic debt remain within international standard thresholds. This however should not undermine the need for greater fiscal management.

In terms of Allocations, a bulk of the economic affairs, similar to last year is still going to the Roads sector. The introduction of the Local Government Equalisation Fund.will be interesting to see how it pans out.

It is motivating to see that the constitution process has been budgeted for, what is intriguing is to what level of the process will these funds move the draft constitution.

The doubling of presumptive tax on public service vehicles is reasonable and will help reduced "free riding". Other import duties on edible oils and roofing sheets will go a long way to help the local manufacturing companies.The removing of 5 percent customs duty on aviation fuel will also help improve the profitability of the aviation industry which should translate into better tourism packages and numbers of visitors.

The 2015 Budget did not address the 2014 inflation targets which according to our current trajectory Zambia will not be able to meet.In the 2014 Budget Zambia estimated and inflation rate of 6.5%, Inflation now stands at 7.8%.This is the reason even the 2015 inflation projections were revised upwards to 7%. Growth will be much in line with projections for 2014 and 2015 driven by the Governments ambitious infrastructure programme, Agriculture, manufacturing, transport and communications.

Click the link below to download the full analysis

2015_Zambia_Budget_Analysis