Zambian 2013 Budget Reviewed by Kampamba Shula

On 12 October 2012, the Minister of Finance, Hon. Alexander Bwalya Chikwanda, MP, announced the 2013 National Budget. Budget highlights and taxation and other changes as contained in the Budget speech and the Zambia Revenue Authority (“ZRA”) publication.

INDECO (IDC): Past Problems and Opportunities Analysed by Kampamba Shula

INDECO (IDC): Past Problems and Opportunities Analysed

Critical Review of IMF 2013 Zambia ARTICLE IV CONSULTATION report by Kampamba Shula

Debt management is still on track The agreed norm is that for internal borrowing the threshold is 25 per cent of GDP but our debt stands at K17 billion, which is 15 per cent of GDP and for external borrowing, the threshold is 40 per cent and our debt is US$3.1 billion which is 14 per cent of GDP, so we are far below the agreed norms. So even in the long term , Zambia is still on track.

US Economy 2014 First Quarter Analysis and Outlook by Kampamba Shula

New data shows the U.S. economy contracted in the first quarter of this year, keeping pace with shifting expectations but down sharply from the prior already disappointing estimate.

Zambia Debt Analysis

Some might say that Zambia should not borrow externally and even as sincere as they may be they are wrong. When the Government borrows locally “Crowing out” happens.

Tuesday, October 21, 2014

Zambia Budget Review: Revenue and Expenditure (2004-2014) by Kampamba Shula

1.

Trend analysis

1.1.

Revenue

1.1.1.

Overview

1.3.

Expenditure

1.3.1.

Overview

Monday, October 13, 2014

2015 Budget Review and Analysis by Kampamba Shula

2015 Budget

1.1. Economic developments in 2014

• Current estimates are that the Zambia economy will create 120,000 new formal sector jobs mostly from the private sector.

• Preliminary projections are that real GDP growth will be higher than the projected 6.5 percent for this year. This will be mainly driven by a good harvest in the 2013/2014 farming season, increased electricity generation, investments in private and public infrastructure and growth in manufacturing as well as in transport and communications.

• The Treasury took measures to consolidate the fiscal position. These measures included actions to contain the size of the public sector wage bill and streamlining of expenditure towards priority programmes. As a consequence, the end year budget deficit is expected to be within the programmed level of 5.5 percent of GDP compared to 6.5 percent in 2013.

• Inflation was contained within single digits over the first nine months and was 7.8 percent in September 2014 from 7.1 percent in December 2013. The slight increase was due to the depreciation of the Kwacha, mainly in the first half of the year, and the pass-through from upward adjustments in fuel prices and electricity tariffs.

• The first half of 2014 experienced a rapid depreciation of the Kwacha against major currencies, reaching a high of K7 per US dollar in May. This partly arose from a reduction in the supply of foreign exchange to the market, particularly from the mining sector, and subsequent speculative behaviour. In response, the Bank of Zambia tightened monetary policy through a number of measures, including adjusting upwards the policy rate, increasing the statutory reserve requirement and extending its application to Government and Vostro accounts.

• The tight liquidity conditions came at the cost of a temporary rise in interest rates which constrained access to credit. Having achieved relative stability in the foreign exchange market, the Bank of Zambia has, since July 2014, eased liquidity conditions. As a result, the daily average overnight interbank rate reduced to 12.8 percent as at end-September 2014 from 25 percent at end-June 2014.

• During 2014, trading activity on the Lusaka Stock Exchange (LuSE) increased, reflecting improved investor sentiment and participation on the local bourse. Market capitalisation increased by 8 percent to K62.9 billion while the All-Share index rose by 17 percent to 6,620.9 by end-September 2014.

• To comply with the LuSE listing requirements, Government will itself reduce its shareholding in ZCCM Investments Holding Plc to 60 percent from 87 percent.

• The overall Balance of Payments is expected to register a surplus of US $486.0 million in 2014 compared to a deficit of US $344.9 million in 2013. This surplus is attributed to improvements in both the current and financial accounts. Higher copper export volumes and the receipt of Eurobond proceeds account for the expected improvements.

• Consistent with improvement in the overall Balance of Payments position, gross international reserves are projected to increase to US $3.2 billion at end-December 2014, representing 3.6 months of import cover, from US $2.7 billion or 3.0 months of import cover recorded at end-December 2013.

• The stock of Government’s external debt as at end-September 2014 was US $4.7 billion. This represents an increase of 34 percent from US $3.5 billion as at end 2013. The increase in the external debt stock was mainly on account of the US $1 billion Eurobond that was issued in April as part of programmed financing in the 2014 budget. The total external debt service for the first nine months of 2014 amounted to US $126.2 million which is less than 3 percent of the domestic revenues.

• Zambia’s domestic debt including arrears as at end-September 2014 stood at K21.9 billion representing an increase of 5.6 percent from K19.7 billion as at end-December 2013. The increase was largely on account of programmed financing for the 2014 Budget.

1.2. Macroeconomic Objectives, Policies and Strategies for 2015

The Government in 2015 will continue to focus on industrialisation together with job and wealth creation, so as to reduce poverty and inequality on a sustainable basis. This will be achieved by investing in sectors that have been identified to best promote employment for our youthful population, significantly increase productivity in the economy by empowering our workers with the requisite skills for the 21st century, contribute to higher and inclusive economic growth, and develop the rural areas to narrow the urban-rural divide. These include the agriculture, tourism, manufacturing and construction sectors.

The specific broad socio-economic policy objectives for 2015 will be to:

(a) Achieve a real GDP growth rate of above 7.0 percent;

(b) Achieve an end year inflation rate of no more than 7.0 percent;

(c) Increase international reserves to at least 4.0 months of import cover;

(d) Raise domestic revenue collections to at least 18.5 percent of GDP;

(e) Contain domestic borrowing to no more than 2.0 percent of GDP;

(f) Accelerate the diversification of the economy, and continue the drive to create decent jobs, especially for the youth; and

(g) Accelerate implementation of interventions in the health, education and water and sanitation sectors.

1.3. 2015 Budget

In 2015, Government proposes to spend K46.7 billion or 24.6 percent of GDP. This will be financed from domestic revenues of K35.1 billion which is 75.2 percent of the total Budget and 18.5 percent of GDP. Grants from cooperating partners of K1.2 billion or 2.6 percent of the total budget will complement domestic revenues. Domestic borrowing is projected to be 2.0 percent of GDP translating to K3.8 billion while K4.2 billion is a combination of foreign programme and project financing. The balance of K2.4 billion is earmarked proceeds from the 2014 Eurobond.

1.3.1. 2015 Expenditure Allocations by Function

1.3.1.1. General Public Services

• K12.0 billion or 25.8 percent of the budget has been allocated for General Public Services. To ensure that Government meets both its domestic and external debt obligations, K2.9 billion and K2.4 billion have been provided respectively. Other notable expenditure allocations under this category include K669.4 million for grants to Local Authorities of which K586.8 million is for the Local Government Equalisation Fund.

• To ensure the continuation of infrastructure development in the newly created provinces and districts, K500 million has been provided in 2015. Further K210 million has been allocated for the Constituency Development Fund.

• The constitution making process has continued keenly and in earnest, as the Government discusses the matter with all interest groups it has allocated K29.3 million towards this process.

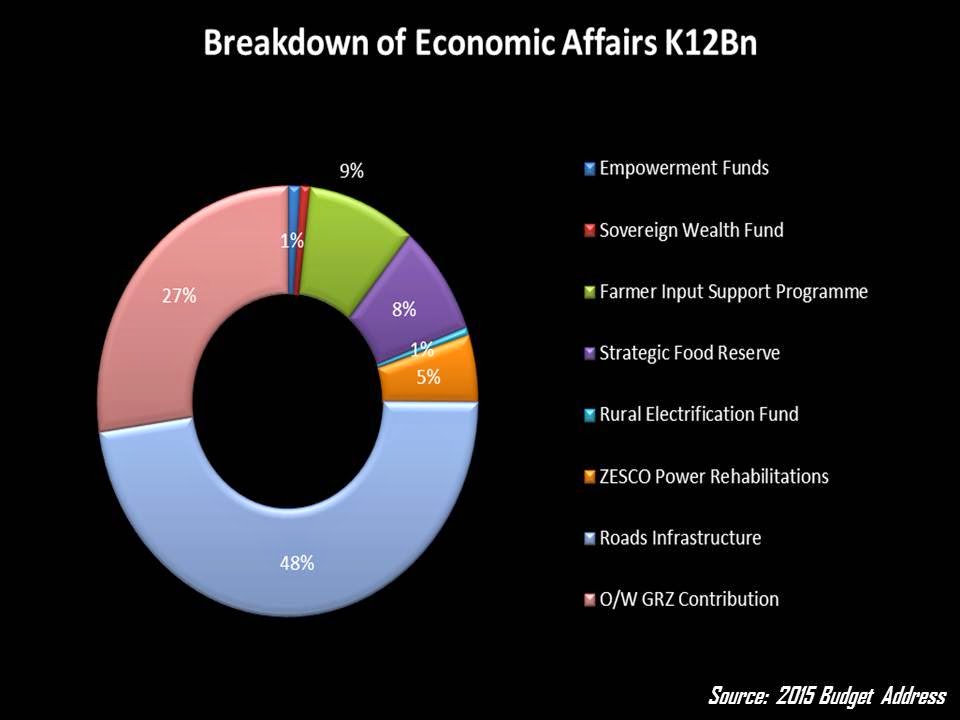

1.3.1.2. Economic Affairs

• Government proposes to spend K12.7 billion or 27.3 percent of the total budget to support the economic sectors and lays the basis for further prosperity for our people. In this regard, an allocation of K5.6 billion has been set aside for road infrastructure, including the Link Zambia 8000 and the Pave Zambia 2000 projects.

• Diversification from maize remains paramount in attaining more inclusive growth and economic independence. In this regard, K254.9 million has been allocated towards the E-Voucher System which will allow farmers more flexibility of choice in the inputs they receive. A further, K1.1 billion has been allocated to the Farmer Input Support Programme (FISP). In 2015, it is expected that 1,000,000 farmers will access inputs through the E-Voucher and FISP programmes.

• Government will continue promoting private sector participation in grain marketing by limiting grain purchases by the Food Reserve Agency to the 500,000 metric tonnes required for the strategic food reserve. In this regard, Government has provided K992.9 million for strategic food reserves.

• To promote irrigated agriculture and increased access to water resources, Government has allocated K164.5 million towards the construction and rehabilitation of dams to achieve our target of an additional 17,500 hectares under irrigation by 2016.

• To promote livestock and fisheries, Government has allocated K307 million for livestock disease control measures and aquaculture development.

• To address the challenges posed by the ever growing demand for electricity, Government has provided K600 million to ZESCO for power generation, transmission and distribution. A further K70.7 million has been allocated to increase the number of rural communities across the country connected to the national grid under the Rural Electrification Programme.

• To continue nurturing the entrepreneurial spirit Government has allocated K123.7 million to various empowerment funds that cater for the youth, women and SMEs

• Government has allocated K100 million for the establishment of a sovereign wealth fund. Going forward, a significant propotion of the dividends from state-owned enterprises that will fall under the Industrial Development Corporation will form part of the fund.

1.3.1.3. Education and Skills Development

Government proposes to spend K9.4 billion or 20.2 percent of the total budget in the education sector. In an effort to reduce the pupil teacher ratio, 68 percent of this amount will go towards the recruitment of 5,000 teachers and sustaining the current establishment. Government has also provided K1.1 billion for infrastructure development for early childhood, primary and secondary education.

K650 million has been allocated to commence construction of additional student accommodation at the University of Zambia, Copperbelt University, Mulungushi University and Evelyn Hone College, and to continue the construction of new universities. The new Universities that are earmarked for completion in 2015 are Paul Mushindo, Chalimbana and Palabana.

Government will embark on the construction of King Lewanika and Luapula Universities in 2015.Robert Kapasa Makasa, Mukuba and Kwame Nkrumah Universities are almost completed.

A further K79.6 million has been allocated towards the construction of nine trades training institutes across the country of which three will be completed in 2015 in Isoka, Kalabo and Mwense. In addition, K28.5 million has been allocated towards the procurement of research and development equipment as well as the commencement of the construction of a National Science Centre in Chongwe, a Fisheries Centre in Samfya and a Mineral Research Centre in Solwezi.

To address the challenges facing our vulnerable school leavers to access tertiary education at our colleges and universities, Government has raised the allocation to bursaries by 27.9 percent to K200.2 million from the 2014 allocation of K156.5 million. The cost of publicly provided tertiary education per student is among the highest in the SADC region.

1.3.1.4. Health

In line with Government’s objective of providing equitable access to quality health care, Government has allocated K4.5 billion or 9.6 percent of the overall budget in 2015 to the Health Sector. Of this allocation, K268.2 million has been allocated for the construction and rehabilitation of health infrastructure in various parts of the country.

An allocation of K753.5 million has been set aside for the procurement of essential drugs and medical supplies. K52.5 million has been allocated for the net recruitment of over 2,000 health personnel.

1.3.1.5. Housing and Community Amenities

Government has allocated K798.7 million for housing and community amenities, of which K541 million will be for the rehabilitation and construction of water supply and sanitation infrastructure in the rural, peri-urban and urban areas.

1.3.1.6. Public Order and Safety

K2.2 billion has been allocated to maintain public order and safety. Key interventions will involve modernisation of our security wings; recruitment of security personnel including immigration and prison officers; rehabilitation of prison infrastructure; and construction and rehabilitation of staff houses.

1.3.1.7. Social Protection

Government has provided K1.3 billion for social protection of which K805 million is for the Public Service Pension Fund, K180.6 million for the social cash transfer scheme and K50 million for the food security pack. The allocation to social protection translates to 2.7 percent of the overall expenditure in 2015.

1.3.1.8. Other functions

K3.7 billion has been allocated to the remaining functions of Defence, Environmental Protection and Recreation, Culture and Religion. Of this amount, K3.2 billion is for Defence.

1.3.2. Revenue Estimates and Financing

The proposed revenue measures have been framed in the context of Government’s aim to consolidate its fiscal position and make the tax system simpler and more effective. This entails, inter alia, accelerating the modernisation of tax administration and restructuring the current mining tax regime in order to capture more resources to address public expenditure needs.

1.3.2.1. Revenue Measures

• Government proposes to double the presumptive tax payable by these operators. This measure will raise additional revenue of K3.8 million.

• Government proposes to increase the specific duty rate on refined edible oil to K2.20 per kilogram from 85 Ngwee per kilogram in order to bring it at par with the ad valorem rate of 25 percent charged on imported refined edible oil

• In order to stimulate the local manufacturing industry and sustain employment in the sector, Government proposes to increase customs duty on explosives to 25 percent and on roofing sheets to 30 percent.

• Government proposes to increase excise duty on imported un-denatured spirits of alcoholic content of 80 percent or higher by volume to 125 percent from 0 percent. This proposed measure will only apply to importers who are not licensed to manufacture excisable products while the licensed manufacturers will continue to account for excise duty at the point of sale of the manufactured potable spirits at the current excise duty rate of 60 percent.

• Government proposes to remove the 5 percent customs duty on aviation fuel in order to reduce costs in the aviation industry. As a result of this measure Government will forego K6.3 million in revenue.

1.4. Changes to the Mining Fiscal Regime

Government and the mining companies, Government proposes to redesign the mining fiscal regime by replacing the current two tier system with the following simplified mining tax structure:

a) 8 percent mineral royalty for underground mining operations as a final tax;

b) 20 percent mineral royalty for open cast mining operations as a final tax;

c) 30 percent corporate income tax rate on income earned from tolling; and

d) 30 percent corporate income tax rate on income earned from processing of purchased mineral ores, concentrates and any other semi-processed minerals, currently taxed as income from mining operations.

The proposed changes to the mining tax regime will not apply to mining of industrial minerals. The expected additional revenues, in 2015, as a result of these new measures are estimated at K1.7 billion.

Analysis

The 2015 Budget is in line with the Medium term expenditure framework (2015-2017). The contentious issue arising from this budget is most prominently the Wage Freeze. In September 2013 the Zambian Government approved a harmonious increase of wages for civil servants. The increase was as much as 100% for some civil servants. The wage increase was much anticipated but its size was larger than predicted. To balance this out the Government introduced a wage freeze on the salaries of civil servants for 2 years.There have been calls from people in the media and others to drop the wage freeze.In truth and in free market legality the Government was not supposed to impose a wage freeze. But a closer look at the fiscal position indicates that Government cannot actually afford to drop the wage freeze right now after the unilateral increase in 2013. Unions will continue to fight the wage and they should (its their job) but the wage freeze might only be dropped in 2016.

The mining fiscal regime change is a bold move towards royalty taxes and its success will hinge on the Zambian Governments ability to actually monitor and evaluate the effectiveness of the new tax system.

Debt levels of $4.7 billion and K21.9 billion for external and domestic debt remain within international standard thresholds. This however should not undermine the need for greater fiscal management.

In terms of Allocations, a bulk of the economic affairs, similar to last year is still going to the Roads sector. The introduction of the Local Government Equalisation Fund.will be interesting to see how it pans out.

It is motivating to see that the constitution process has been budgeted for, what is intriguing is to what level of the process will these funds move the draft constitution.

The doubling of presumptive tax on public service vehicles is reasonable and will help reduced "free riding". Other import duties on edible oils and roofing sheets will go a long way to help the local manufacturing companies.The removing of 5 percent customs duty on aviation fuel will also help improve the profitability of the aviation industry which should translate into better tourism packages and numbers of visitors.

The 2015 Budget did not address the 2014 inflation targets which according to our current trajectory Zambia will not be able to meet.In the 2014 Budget Zambia estimated and inflation rate of 6.5%, Inflation now stands at 7.8%.This is the reason even the 2015 inflation projections were revised upwards to 7%. Growth will be much in line with projections for 2014 and 2015 driven by the Governments ambitious infrastructure programme, Agriculture, manufacturing, transport and communications.

Click the link below to download the full analysis

2015_Zambia_Budget_Analysis

Thursday, October 2, 2014

VAT Rule 18 Analysis : The Amber Rose and Wiz Khalifa Example by Kampamba Shula

VAT Rule 18: Background and Current Affairs

Valued Added Tax Rule No. 18 has been in existence since 1997 with the intention of making Zambian exports competitive through VAT refunds on exports.

Under Rule 18, the requirement to obtain information from importers outside Zambia’s jurisdiction has proved impractical and results in delayed processing of VAT refunds.

According to a letter by Minister of Finance Alexander Chikwanda to President Michael Sata, seeking his guidance on VAT tax administrative Rule 18, he stated that the uncleared backlog with the mines was in excess of $600 million (K3.6 billion).

Against this backdrop, the Zambia Revenue Authority (ZRA) has amended Rule 18 of the Value Added Tax (VAT) General Rules of 1997 to safeguard Government revenue with effect from September 8, 2014.

ZRA commissioner general Berlin Msiska says Rule 18 affects exporters and the mining sector.

In 2013, the Zambia Revenue Authority (ZRA) amended the rule by way of Gazette Notice No. 26 of 2013 which adjusted all VAT returns to standard rate export sales until proof of compliance to the rule has been made in order for exporters to claim VAT refunds.

According to a letter written by ZACCI president Geofrey Sakulanda to Minister of Finance Alexander Chikwanda, ZACCI highlighted some of the challenges of VAT rule 18 for the minister’s possible consideration.

Mr Sakulanda outlined that prior to the 2013 amendment act, compliance to this rule had been by way of providing to the Zambia Revenue Authority ( ZRA), the documentation of invoices issued by the exporting company, duly completed export documents (Form CE20), release orders by ZRA confirming exit at the border and proof of payment into the company’s bank account.

However, Mr Sakulanda noted that the amended VAT rule 18, in part, particularly Rule 18 (1) (b), requires that in addition to the requirements above, an exporting company must also provide copies of import documents for the goods bearing a certificate of importation into the country of destination provided by the customs authority of that country as proof of export.

He argues that the amended VAT rule No. 18, has its own challenges.

Among such challenges is the requirement to produce copies of import documents for the goods, bearing a certificate of importation into the country of destination provided by the customs of that country as proof of export.

Mr Sakulanda stated that exports made to clients in the export markets on such terms that once a consignment is handed over to the client’s agents, the responsibility of the exporter is terminated and the exporter has absolutely no control over the consignment from that point and export invoices are based on the terms of sale.

“It is challenging to obtain information documents to prove importation in most of the export markets for Zambian products. This situation is even worse in one of Zambia’s key export destinations, namely Democratic Republic of Congo (DRC).

“Exporters are not in any way averse to complying with the law but need special consideration to find practical solutions to dealing with this challenge. This situation is detrimental, as it erodes competitiveness especially that our competitors in the regional markets do not require that similar documents to be produced,” Mr Sakulanda said.

VAT Rule 18: The Amber Rose and Wiz Khalifa Example (Ficticious)

(All Characters Ficticious)

A recently divorced couple by the name of “Wiz Khalifa” and “Amber Rose” have son called “Sebastian”.According to the prenupt they signed before marriage, in the case of divorce Wiz Khalifa is required to pay alimony and Child support (depending on custody court case) to Amber Rose per month. For the sake of this example, let’s put Alimony and Child support in one category and call it “VAT”.

Now according to the prenuptial, Whenever Amber rose buys stuff for their son Sebastian she is allowed to claim to be refunded (payed back) from VAT. One of the conditions in VAT is that Amber rose is supposed to provide receipts of every transaction which she buys stuff for Sebastian. This condition is sensible in theory but is a bit difficult to apply in practice. Amber rose can give her friend to take Sebastian to a movie when she is busy and her friend may lose the receipt on the way back. This makes it difficult for Amber to produce a receipt. This condition is difficult to apply so sometimes she usually doesn’t produce a receipt but still gets refunded VAT.

Sometime later, one of Wiz Khalifa’s friends tells him that he has been seeing Amber going to get a lot of expensive manicures, shopping etc. and suspects that the money is from VAT which is supposedly for Sebastian. What makes it worse is that Wiz Khalifa hears that Amber Rose has been seen chilling with a guy called Nick canon and spending money on him.This makes him angry. So this is what Wiz Khalifa decides to do, he enforces the rule that Amber has to provide receipts for every transaction on which she spends money on Sebastian. Similar to before, Amber is unable to provide receipts for some payments for Sebastian which she does through her friend. Wiz decides to hold any refunds until Amber can provide receipts of payments some of which she pays through other people who are not so mindful of the receipts. Therein lies the stale mate.

Now is Amber Rose legally entitled to refunds from VAT, yes. Is Wiz Khalifa legally allowed to withhold VAT until Amber provides receipts, yes. Now Wiz Khalifa legally has to pay Amber Rose the VAT refunds but he has a legitimate reason to ensure that Amber Rose actually spends the money on his son Sebastian.

There are two options

1. Wiz Khalifa can wait till the court case in which Amber Rose will invariably win that he has to pay her the Refunds

2. Wiz Khalifa will need to be level headed. He will legally request (subpoena) a trail of money payments from Amber Rose. This trail will detail for example which friends (yeah they get subpoenaed too) take Sebastian for a movie and where they put their receipts. Wiz Khalifa can then by form of subpoena find out exactly how much money is given to the friend for the movie and whether it corresponds to the amount Amber Rose Claims on VAT. This method is obviously harder because Amber Rose’s friend is not bound by the same legality.But unfortunately is the only logical course of action. In the long run Wiz Khalifa will have to give room for Amber Rose to find a way to comply her friends to product receipts.

Now in this story, Wiz Khalifa is the Zambian Government and Amber Rose is the Mining consortium. VAT refunds refer to the Value added tax refunds that the Zambian Government through ZRA is legally obliged to pay the Mines for exported goods. Now the condition that Amber Rose had to comply with to provide receipts for payments made for Sebastian is the condition that Mining companies must comply with by providing import certificates from the country to which they export.

The problem is that mining companies for example that sell copper to China would use a middle man in London. This middle man may use a future (financial agreement) to broker the deal. He doesn’t provide mining companies with import certificates which the buying party in China is supposed to provide.

There is a solution to this problem, Solution 2. The Zambian Government must legally request (Subpoena) all the Mining companies to disclose all the middle men they sell too. These middle men will then ALSO have to be subpoenaed to provide their end sources. The importing buyers will disclose which country they operate in and a memorandum of understanding will have to be signed with the customs authority in that country.In the long run mining companies will need to be given time and support so the can ensure that their middle men get copies of import certificates from the destination countries. It’s either this or VAT Rule 18 gets amended, Again.

As it stands now in a stalemate, the Government can either pay the Mines back the Vat Refunds or it can modify VAT rule 18 so that exports are Zero rated in the first place.But Zero rating is not really an option on the table so the Government will have to be smarter about the transparency.

That transparency is open to interpretation.